How to influence the rise and fall of encryption market and the conversion between bull and bear?

Nov 20, 2024

1. The interest rate hike cycle will start. What will happen to the overall economic environment?

In 2024, when the Fed's interest rate hike is a foregone conclusion, the most important question now is: What impact will it bring once the Fed starts the interest rate hike cycle? In particular, what impact does it have on the economic environment? After all, the economic foundation determines everything.

To answer this question, we first need to understand the nature of the Fed's interest rate hike. This question, our original article in Ouyi College: "Fed raises interest rates (II): What is the essence of raising interest rates? It has been answered in the book: the essence of raising interest rates is to develop the American economy through the adjustment of monetary policy in the United States, but objectively it will evolve into the financial harvest of the United States to other countries/regions and an industry, and these two results are complementary and mutually causal.

In order to achieve the above results, the Federal Reserve will take advantage of the status of the United States as the only superpower in the world to take a series of measures after raising interest rates or even before raising interest rates. These measures will cause some obvious changes in the overall economic environment of the world. Specifically, there are three main changes: global capital will accelerate its return to the United States, the world will enter an era of high inflation, and there may be more black swan incidents such as the conflict between Russia and Ukraine. The changes in these three economic environments may all have a major impact on the encryption market, even the impact of "no eggs under the nest".

Change one: global capital began to accelerate its return to the United States. At the beginning of the Fed's interest rate hike, this will be a very important phenomenon and a threat that the whole world will face. Because after the interest rate in the United States is raised, capital will flow to places with high interest rates in order to make profits. At this time, in order to avoid a large outflow of international capital, most countries will follow the United States and raise interest rates simultaneously to maintain the spread between their currencies and the US dollar, and the motivation for international capital outflow will be smaller.

However, the development level of different countries is different. Following the Fed's interest rate hike, the real economy may run out of food, or the asset bubble in their own countries may burst. If you don't raise interest rates, there may be capital outflows and currency depreciation, and the consequences will be more serious. Even if the two evils are the lesser, you choose to follow the Fed to raise interest rates, but you don't know how much and at what pace the Fed will raise interest rates, and it may not take long for your economy to collapse.

Change 2: The inflation level in the world has greatly increased, especially in other regions, making the United States a value depression. The core element is the price increase of energy and food. In Europe, for example, the recent sanctions against Russian oil and gas have caused oil prices to soar. The US WTI crude oil futures price once exceeded $130/barrel, and the market even predicted that the next sanctions might make the international oil price soar to $200/barrel. Coupled with the previous sanctions against Beixi II, a series of operations have successfully raised the inflation level in Europe, and Europe has released no less water during the epidemic than the United States.

Only when the United States pushes up the inflation level of the whole world can the real interest rate of the United States be higher than that of other major economies in the first half of the interest rate hike cycle, so as to expand the spread and increase the attraction to capital. The so-called real interest rate is almost nominal interest rate+economic growth rate-inflation rate.

As the world's largest food exporter, the United States firmly controls the pricing power of international food prices. If the goal cannot be achieved through energy operation, the operation of food prices will be the killer.

Change 3: The probability of regional conflicts or turbulent black swan events is greatly increased. If many countries resist the pressure at the beginning of raising interest rates, and the speed and scale of capital returning to the United States are less than expected, then it is time for the United States to use its superpower ability to create turbulent situations in other regions and intimidate capital into flowing to the United States.

For example, the current Russian-Ukrainian conflict is the result of the constant fire of the United States. Everyone with discerning eyes knows that the real purpose of the Russian-Ukrainian conflict is not Russia and Ukraine, but the whole euro zone, the European Union, the third largest economic entity in the world, and the euro, the second largest international currency. This volume can make the United States full. Of course, the United States will not just put eggs in one basket. As one of the three poles of the world economy, East Asia and Southeast Asia may also be one of the targets, which will greatly increase the probability of black swan events in the world economy and encryption market.

It can be said that although the Federal Reserve temporarily stabilized the pace of economic recession due to the epidemic, it also prompted many markets, including the encryption market, to "flourish". However, it is time to raise fish and collect nets, and the money printed by the Federal Reserve out of thin air needs to be supported by real assets. Otherwise, the collapse will be the United States' own economy, and the opening of the interest rate hike cycle will, in the final analysis, allow global capital to return to the United States to support the printed dollars. This will drain the water from other countries, regions and markets, and the high-quality assets in other markets will plummet. Wall Street's capital will attack the world again, bargain-hunting global assets, and complete the transformation from virtual to real.

Although everyone in the United States knows the routine, it has made it successful again and again, because the whole world and even every country are not monolithic, coupled with the political infiltration and capital kidnapping of the strength of the American superpower, even if you know the routine, you can't do anything. After all, there is internal disunity and poor strength.

It is a core event for the United States to restart raising interest rates. As a capital-oriented country, it is fighting for the core interests of the United States, so don't underestimate the determination and all-out ferocity of the United States to fight for it.

2. under the cover of the nest, how to affect the rise and fall of the encryption market and the conversion of bulls and bears?

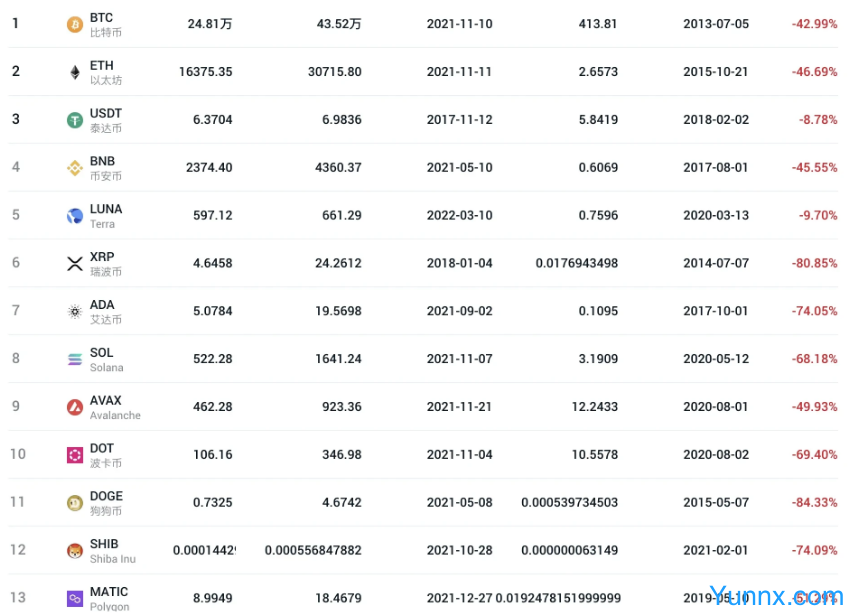

Since November last year, when the Federal Reserve explicitly started to reduce debt and raise interest rates, the whole encryption market has started a falling mode. As of this writing (March 10, 2022), Bitcoin has fallen by 42.99% from its all-time high, and ETH has fallen by 46.69%. Other sectors fell even worse. Even public chain projects, which were the infrastructure of the whole industry and had the most outstanding performance before, generally fell by 50-70%, while some "old mainstream coins", such as BCH and LTC, fell by 80-90%.

As can be seen from the above data, the degree of panic in the encryption market about the Fed's interest rate hike. To sum up, the impact of the Fed's interest rate hike on the ups and downs of the encryption market and the conversion of bulls and bears will mainly be reflected in three aspects: the short-term or long-term liquidity crisis caused by the return of capital to the United States, the impact on market sentiment, and the sharp price fluctuation caused by the Black Swan incident.

Causing a short-term or long-term liquidity crisis is the most fundamental impact of the US interest rate hike on the ups and downs of the encryption market and the conversion of bulls and bears. As mentioned above, the Fed's interest rate hike will use various means to promote the return of global capital to the United States, and most of these returned capital will flow into the US debt and US stock markets. Because in the case of global tightening and increased risks, the first consideration of capital is two points, one is security and the other is rate of return. Considering both safety and yield, from the historical and practical point of view, US debt and US stock market are the only two choices.

Although both US stocks and US debt are at a high level now, it is possible to take over when entering, but this is a worse world. If other markets fall, they may collapse directly, and capital can only be selected by comparison. Moreover, for investors, US stocks are related to the national luck of the United States. They are in it, of course, they will not think that there will be any big problems in the United States. They will think that at least the United States is the world's number one power, and even if the world collapses, it will be the last one. This is the biggest misunderstanding caused by different perspectives.

If global capital accelerates to return to the United States after the Fed raises interest rates, the volume of US stocks with US debt will gradually absorb the capital flows in other markets. In terms of volume, the US debt is now 30 trillion US dollars, while the US stock market is as high as more than 50 trillion US dollars. The peak of the total market value of the encryption market reached 3 trillion US dollars at the end of last year, which is completely different from one level. Now that the Fed has not raised interest rates, there is only $1.74 trillion left in the encryption market, which has dropped by $1.26 trillion, and nearly half of the market value has disappeared. For any investment market, the loss of capital flow is a disaster, and the encryption market is no exception.

After the Fed raises interest rates and even starts to shrink the table, the global capital will accelerate its return. As a small pool next to the sea, the encryption market may be quickly sucked up, unless the development speed and quality of the encryption market are hard enough to form a small and beautiful self-circulation, and the bubble is already crowded, but even so, it will be greatly weakened.

The expectation that the Fed will raise interest rates will make the whole market start to feel risk-averse. This not only makes a large number of investors cautious, or even withdraw from the market, but also leads to more and more serious differentiation of the encryption market: assets with great value consensus, such as Bitcoin, ETH and some truly ecological and application projects, may attract most of the funds in the encryption market, thus maintaining a relatively strong position, or even taking advantage of the interest rate hike to rise a wave.

And most of the growth projects that may be valuable in the future may start to fall endlessly after losing the nourishment of capital; Other projects that have no market ability and users at all will collapse as the final result. Now the market differentiation has actually begun, and the effect is already obvious. From the above "the decline from the historical high", we can already see the clue.

The survival of the fittest in the market is ruthless. Only by surviving the impact of the market and crossing the bull-bear project can we be qualified to survive and usher in a brilliant future. From this perspective, the reshuffle of the encryption market caused by the Fed's interest rate hike cycle may be an opportunity for investors to know which projects are really valuable. After all, we don't know who is swimming naked until the tide recedes.

The drastic price fluctuation caused by the Black Swan incident will inevitably happen in the encryption market during the Fed's interest rate hike cycle, and the frequency of occurrence may be high, just like the ups and downs caused by the Russian-Ukrainian conflict.

In addition to the fact that Americans returned to the United States to create conflicts around the world and make capital feel insecure, the Black Swan incident spread to the encryption market. The opening of the Fed's interest rate hike cycle will also detonate the internal contradictions in many countries/regions and markets, resulting in the explosive Black Swan incident, just as the Fed's interest rate hike in history caused the global financial crisis in 2008, the technological Internet bubble at the beginning of this century, and the Southeast Asian financial crisis in the last century.

Of course, the impact of these black swan events on the encryption market is not all negative. For example, the devaluation of Turkey and the Cyprus crisis have caused some people to turn to digital assets such as Bitcoin. However, the surge and plunge caused by the Black Swan incident will make many investors lose their assets or even return to zero when they are caught off guard.

From the philosophical point of view, the internal cause is the fundamental reason for the development of things, and the external cause works through the internal cause. The bubble that can be punctured by the Fed's interest rate hike is definitely a problem with its own development, especially in the place where bubbles are generated by infinite birth during the flood season, and the risk is the greatest.

The encryption market conforms to the above situation to some extent. In this big water release, the encryption market grows rapidly and looks prosperous, but bubbles are also spawned in large numbers. When the Federal Reserve raises interest rates, these bubbles will inevitably burst. However, from a long-term perspective, the bursting of bubbles may not be a good thing.

It's just that digital assets are mirror images of real assets. If the real world collapses, it will collapse along with it, or it will become a refuge for some real assets, and it will take time to give the results.

Finally, the world is facing a "great change that has never happened in a century". Whether it is the profound adjustment of the current international structure and system, the profound reform of the global governance system, or the contradiction generate caused by the depletion of the "old" technology dividend and the gradual germination of new technologies and the overall stagflation and slowdown of the world economy, it will gradually emerge in the future.

As a boat in the sea, the encryption market, as water drops falling on this boat, has no choice but to embrace change and storm with open arms, because retreat will never usher in a bright future.

Recommend Apps

Preview: