Shrinking the table is the beginning of the plunge and the end of the bull market

Nov 20, 2024

The "dark history" of the Fed's shrinking table, which collapsed as soon as it was shrunk?

In 2022, the Fed will mainly do three things, namely, accelerating the reduction of the scale of bond purchases, raising interest rates, namely, raising the federal interest rate and reducing the balance sheet. These three things are progressive step by step, and the lethality may increase exponentially with each step.

Now, the reduction of bond purchases is coming to an end, and the market has digested the expectation that the Fed will raise interest rates many times in the future. This means that among the subsequent factors that affect the market, table shrinkage will be the key factor.

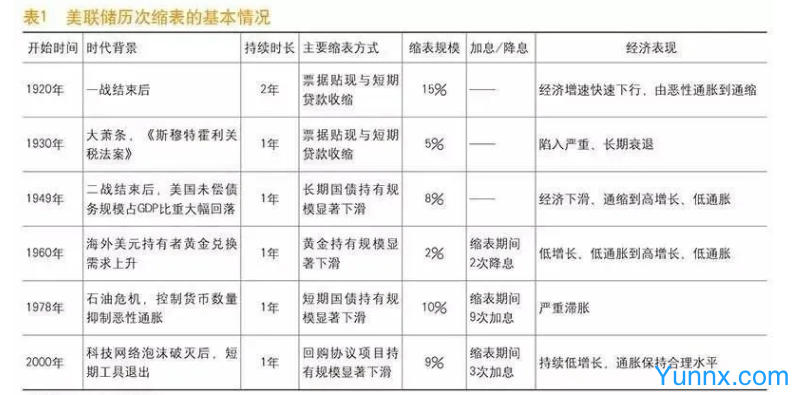

Historically, the Fed has tried to shrink its table six times in the past, in 1921-1922, 1928-1930, 1937, 1941, 1948-1950 and 2000 respectively. Almost every time, it was notorious, and five of them ended in economic recession. As shown below:

According to the six times in the history of the Federal Reserve, it can be found that the contraction has caused great downward pressure on the economy and the market. Among them, in 1920, the Federal Reserve shrank its table for six times, lasting for one to two years, with a scale of 15%, the stock fell, the economy declined, and inflation turned into deflation; In 1930, during the Great Depression in the United States, the passive contraction of the table led to the decline of stocks and the collapse of the economy; In 1949, after the expansion of the table to support the war during World War II, the Federal Reserve took the initiative to shrink the table, which led to the first suppression of the stock and then the rise; In 1969, because of the Marshall Plan, the Fed passively shrank its table, which led to a slight impact on the stock market and the economy. From 1978 to 1979, during the second oil crisis, the table was passively shrunk, but it failed to curb inflation, and the stock and economy all went down; 2000 and 2011: After the bursting of the Internet bubble and the September 11th terrorist attacks, the table was actively shrunk, which was caused by the withdrawal of the short-term liquidity rescue measures of the Federal Reserve, and the impact was not significant.

The shrinking of the Fed table has a great impact on the world economy and investment market, and it is basically a negative impact. Specifically, the world economic growth will decline. According to the data of the World Bank, the contraction in 1960, 1978 and 2000 has little impact on the global economic growth in the current period, but the global economic growth will decline in the next 1-2 years, and the US economic growth will also decline to varying degrees in the current period of contraction.

Judging from the global flow of capital, foreign direct investment (FDI) in other countries will drop significantly after the Fed reduced its balance sheet. For example, in 2000, the net inflow of FDI in high-income countries and low-and middle-income countries dropped by 47.87% and 8.55% respectively. On the contrary, the net inflow of FDI in the United States continued to increase after the contraction. For example, the foreign direct investment flowing into the United States increased by 101.72% and 11% respectively during the contraction in 1978 and 2000. From this point of view, the Fed's contraction can be said to be a sickle of harvest for the whole world.

As far as the global investment market is concerned, basically every time the table is reduced, it is mainly a big drop in the long run. Except for the table reduction in 1949, the other five table reductions are all during or after the table reduction, resulting in a sharp drop in the prices of investment markets such as stocks. Judging from the latest shrinking table, the shrinking table began in early 2018 and lasted for one year. The US stock market and other markets around the world also fell for one year. Bitcoin and the entire encryption market also directly turned bull into bear, falling for one year, of which Bitcoin fell from nearly 20,000 US dollars to more than 3,000 US dollars, a drop of more than 80%. It can be said that the contraction cycle of the Fed is almost synchronous with the decline cycle of investment markets such as the stock market, which is very worrying.

The Fed has now begun to discuss the issue of table shrinkage. The minutes of the January FOMC meeting released last Thursday also explicitly mentioned the issue of table shrinkage. If the subsequent interest rate increase for two or three times has little effect, the possibility of the Fed shrinking the table ahead of schedule cannot be ruled out. Federal Reserve Governor Waller mentioned last Friday that "the Fed can start to reduce its balance sheet shortly after raising interest rates". Bullard, chairman of the St. Louis Fed and one of the FOMC voting committees next year, also tends to open the contraction table as early as possible. It can be said that the big killer of shrinking tables has been moved out of the arsenal by the Federal Reserve, and will be thrown out when the right opportunity comes.

Why does the Fed shrink its watch every time?

We know that the explosion principle of "gun-type" atomic bomb is: the initiation controller automatically detonates the explosive, which quickly compresses two hemispherical fissile materials into a flat sphere and reaches a supercritical state. The neutron source releases a large number of neutrons, which makes the chain reaction proceed rapidly and releases a large amount of energy in a short time. This is the atomic bomb explosion with great destructive power.

By analyzing the recent interest rate hikes by the Federal Reserve, we will find that in each round of interest rate hikes by the Federal Reserve, in the initial interest rate hike stage, the market is not very face-saving, and the horse is running and dancing. Until the process of shrinking the table is started, the market will really usher in a decline, and even bring disastrous consequences to the world: all investment markets will plummet and even cause a great recession.

The Fed's interest rate hike is like the "explosive" of the atomic bomb, and the contraction of the table is the big bang of the atomic bomb. Why is shrinking tables so powerful? This can be analyzed from the Fed's shrinking table itself and the reasons.

The shrinking of the Fed's balance sheet is simply an act of reducing the size of its own balance sheet. By directly selling its bonds or stopping the reinvestment of maturing bonds, the Fed realizes the direct recovery of the base currency, which is a stricter austerity policy than raising interest rates. Shrinking the table can be called a "nuclear weapon" in the Federal Reserve's ammunition depot, which means officially announcing to the world that the comprehensive tightening monetary policy of the United States has begun to come.

In early 2020, because of the epidemic, the Federal Reserve launched an unrestricted bond purchase plan to boost the market and reduce the long-term borrowing costs of enterprises and households. So far, the Fed's balance sheet has reached $9 trillion, which is more than twice as much as before. These huge balance sheets mainly include US Treasury bonds and MBS securities.

US Treasury bonds are US bonds issued by the US Treasury. After the Federal Reserve bought US Treasury bonds, it gave all the money to the Ministry of Finance, and then the government "issued money"; MBS securities are mortgage-backed bonds, that is, the loans that meet certain conditions in the housing mortgage loans are concentrated to form a collection of mortgage loans, that is, the Federal Reserve has carried all the pots of real estate liabilities. The former way is to increase the cash flow of US dollars by issuing treasury bonds, and the latter way is to increase the cash flow by lending. The meaning of shrinking the table can be simply understood as that the Fed not only stopped buying bonds, but also began to sell bonds to recover dollars.

An important task for the Fed in the future is to deal with the 9 trillion US dollars balance sheet quickly, recover the US dollars after the sale, and reduce the circulation of the US dollars at the root. This is also a key step to recover the US dollars, which may fundamentally drain the "water" in the market. At that time, almost all markets, including the encryption market, will become dry, and all creatures in the market will face the threat of death.

Judging from the reasons for the contraction of the Fed's table, the continuous interest rate hike may not necessarily push up the long-term interest rate, not only can it not curb inflation, but it may lead to the flattening or even inversion of the yield curve. In other words, the effect of the traditional monetary policy transmission mechanism has weakened. Table shrinking is a quantitative tool. If the overheating of the economy cannot be suppressed by "increasing the price", then "reducing the amount" will be a more direct choice.

Because this inflation is caused by the excessive release of water by the central bank represented by the Federal Reserve, that is, the "exogenous money", the Fed's previous large-scale expansion has flooded the market with liquidity. Now it is difficult to adjust the money supply by adjusting prices (raising interest rates). The more direct way to control the money supply is to reduce the size of the balance sheet. That is to say, this round of Fed rate hike may not achieve the expected effect, and shrinking the table will be the ultimate means, or it may be a means that has a more violent impact on the market.

Therefore, what really scares people this year is not the Fed's interest rate hike, but the fact that the Fed began to reduce the size of its balance sheet. This is the ultimate killer, the atomic bomb of the "Air Force".

To sum up, 2022 may be a year of all-round austerity. If the Fed starts to raise interest rates and shrink the table, we will enter a period of double austerity. Compared with shrinking the table, raising interest rates is not recycling liquidity. If interest rate cuts and QE are compared to stepping on the gas pedal, raising interest rates is equivalent to releasing the gas pedal and the speed will gradually slow down. And shrinking the table is the real direct braking. When you step on the brakes, all the people and things in the car will stop passively, and even be hit by inertia.

Although in the past, the Fed's practice was to enter a period of interest rate hike before it began to shrink its statement, this time, due to the high inflation and systemic risk of the economy caused by the epidemic, the Fed is likely to shrink its statement in advance. Compared with raising interest rates, shrinking its statement is the real nuclear bomb explosion, and its impact on the encryption market may be catastrophic, so it is necessary to pay close attention to it.

Recommend Apps

Preview: