How do I place a Take Profit (TP)/Stop Loss (SL) with Limit Order in Okx?

Aug 08, 2024

Take profit (TP) and stop loss (SL) refer to pre-set trigger prices and order prices. When the latest price reaches the pre-set trigger price, the pre-set order will be sent to the market according to the order price, in order to achieve the effect of take profit and stop loss or chasing up and down. Take profit stop loss is a pair of orders that are set simultaneously. If one order is triggered and executed, the other order will be automatically cancelled. Currently, you can use take profit and stop loss in cryptocurrency trading.

Why set take profit/stop loss in limit orders?

Pre set trading strategy, seize the opportunity for success: By setting the exit point in advance, achieve automated trading strategy without the need to constantly monitor the market.

Risk management and strategic planning: Take profit/stop loss orders can help users set clear profit goals and loss limits, effectively managing risks.

Precise control, grasping market fluctuations: By setting trigger prices, we can accurately control the timing of order execution and better respond to market fluctuations

What is trigger price?

The trigger price refers to when the market reaches this set price, the order will be reported to the market for trading. The trigger price is equivalent to a prerequisite for the commission order, determining when to send the commission order instruction. However, whether the commission order can be fully and effectively executed depends on factors such as the type of commission order, commission price, and market fluctuations.

Example of take profit/stop loss setting:

Example of placing an order:

Commission price: $50000 (the price at which you wish to purchase Bitcoin)

Order quantity: 1 BTC (the quantity you wish to buy)

Set take profit and stop loss:

Take profit trigger price: $55000 (the price at which you wish to take profit)

Stop loss trigger price: $45000 (the price you want to stop loss at)

In this example, when the Bitcoin market price reaches $55000, a take profit order will be triggered and you will sell 1 BTC to lock in profits. On the contrary, if the market price drops to $45000, a stop loss order will be triggered to sell your 1 BTC to limit your losses.

What factors should be considered when setting take profit and stop loss prices?

Market volatility: Consider the volatility of the cryptocurrency you are trading. Markets with high volatility may require a wider range of take profit and stop loss to avoid premature triggering.

Risk tolerance: Set take profit and stop loss levels based on your risk tolerance and trading strategy.

Market conditions: Keep abreast of market trends and conditions in a timely manner, as these can affect the effectiveness of your take profit and stop loss settings.

How to set take profit and stop loss in cryptocurrency trading?

How to set take profit and stop loss when placing an order

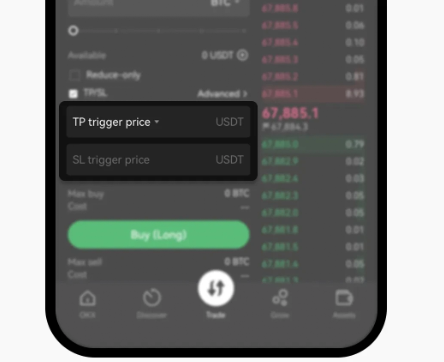

Open the coin trading page of the app, select 'Limit Order' and enter the price and quantity you want, then click 'Buy';

Click on 'Take Profit and Stop Loss' in' Order Confirmation '- enter' Take Profit Trigger Price ',' Stop Loss Trigger Price '- click' Confirm '.

How to set take profit and stop loss after a transaction

Open the coin trading page of the app, select "Take Profit Stop Loss" and "Bidirectional Take Profit Stop Loss", enter the "Take Profit Trigger Price", "Stop Loss Trigger Price" and quantity, and then click "Sell".

Recommend Apps

Preview: