Grid strategy adds trigger conditions to accurately capture every investment opportunity.

Oct 23, 2024

Virtual Currency Automatically Buy Low and Sell High: Grid Transaction

Simply put, grid trading is a procedural behavior, and better trading results can be achieved by means of automated trading tools. A few days ago, OKX has launched the grid strategy trading mode of spot market and contract market. Through the creation of strategy model, the trading strategy is automatically executed, and the programmed trading is completed to place orders, which saves the marking time and does not miss the market conditions.

Recently, in order to improve the user experience and enrich the form of strategy model creation, the OKX spot/contract grid strategy has been completely upgraded, adding trigger conditions such as price trigger to meet the trading needs of different users in different markets and help the implementation of personalized trading strategies.

Add trigger conditions and broaden the strategy boundary.

On the original basis of immediate trigger, this grid strategy upgrade adds two trigger types: price trigger and RSI technical indicator trigger:

Price trigger

The current market price is not within the ideal grid range. Creating the grid now is not in line with the trading strategy. If you want to create it again later, are you afraid of missing the market?

By setting the price trigger conditions in advance to complete the creation of the grid strategy model, the program can automatically start running the grid strategy when the market price reaches the ideal trigger price, thus increasing the flexibility of grid creation, broadening the boundary of strategy execution, and realizing more strategic trading ideas more personally.

RSI technical indicator trigger

In addition to adding price triggers, this upgrade also adds trigger types triggered by RSI technical indicators.

RSI (Relative Strength Index) is one of the most widely used technical analysis indicators in the trading market. According to the principle of supply and demand, it evaluates the strength of the current long and short sides, and then prompts the follow-up operation ideas, including numerical value, intersection, shape, deviation and other judgment principles.

The newly added RSI technical indicator trigger is to use numerical value to make trading judgment. Traders can choose different K-line cycles according to the judgment of long and short directions and different strategy cycles, and set the RSI trigger conditions and trigger values to complete the grid strategy creation triggered by this technical indicator, and the program will automatically start running after the RSI indicator reaches the set value. For example, it mainly includes the following three situations:

(1) Multi-grid strategy (spot grid/contract multi-grid): Multi-grid will only open more and be more peaceful, which is suitable for volatile upward market. Usually, the RSI index uses 30 as the oversold threshold, suggesting that the market is in a downward trend. When the RSI value is lower than the oversold threshold, it often means that the short-term decline will end and may enter a turnaround, which is a good time to see more and do more. The adjustment threshold can be evaluated according to the actual situation.

(2) Short strategy (contract short grid): Short grid will only be open and empty, which is suitable for the downward market. Usually the RSI index uses 70 as the overbought threshold, suggesting that the market is currently overbought. When the RSI value is higher than the overbought threshold, it often means that there may be a callback or a turnaround in the subsequent market, which is a good time to short. Short selling can also evaluate the adjustment threshold according to the actual situation.

(3) Neutral strategy (contract neutral grid): The neutral grid is open/flat above the set price range and open/flat below. Neutral strategy is neither bullish nor bearish, that is, the middle value of RSI index is usually used as the reference value. For example, when the RSI value goes up through 50, the operation of selling short is executed, and vice versa.

How to set trigger conditions to create grid strategy

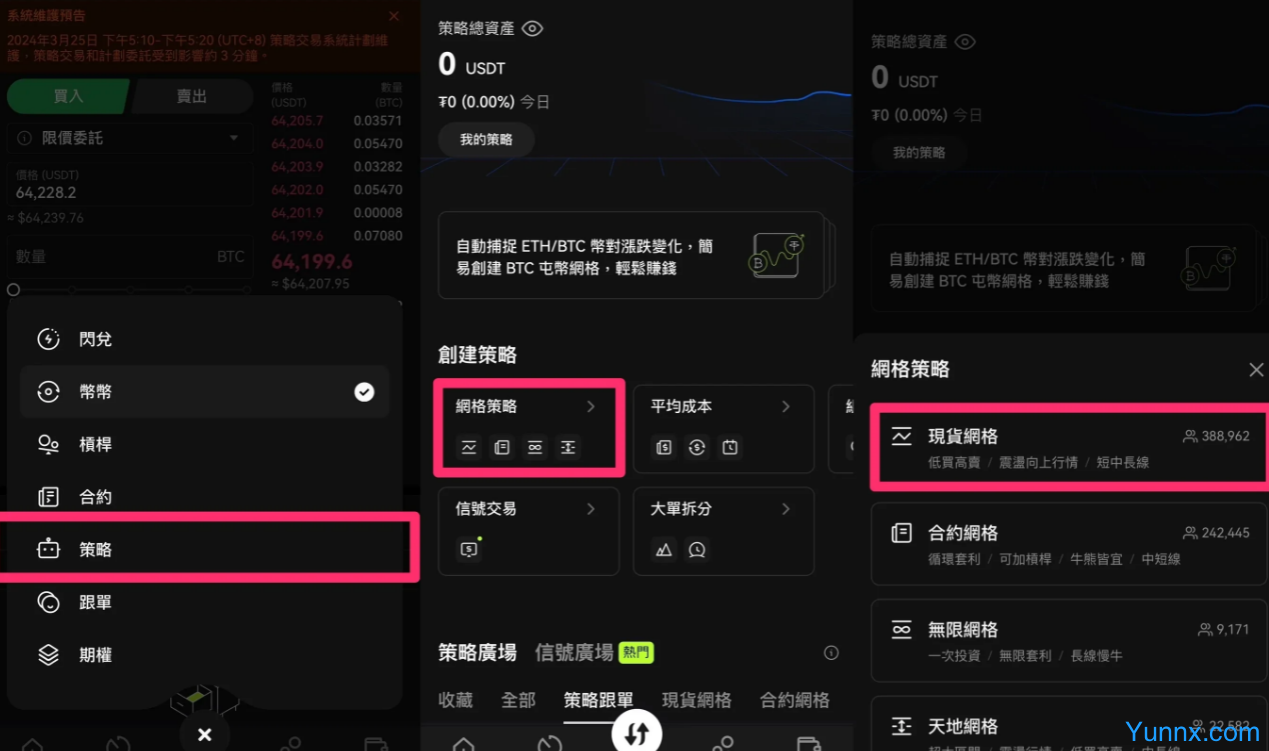

1) Click Transaction-Strategy to enter the OKX strategy page, and select Spot Grid/Contract Grid.

In-depth exploration of grid trading strategy: an automated trading method aimed at maximizing profits from market fluctuations. By setting the buying and selling price points to form a grid, investors can respond flexibly under any market conditions and capture every investment opportunity. Suitable for investors who pursue stable income and want to reduce monitoring pressure.

2) Set the basic parameters of grid strategy, including price range, grid mode and quantity, investment margin amount, etc.

3) Set the grid start and stop conditions in the Advanced Settings area.

Trigger condition 1: immediate trigger/manual stop (preset by the system) Start condition: immediate trigger, and the policy will start running immediately after it is created; Stop condition: Stop manually, and click Stop manually to stop the strategy.

Trigger condition 2: price trigger (to be set manually). After selecting the price trigger, enter the trigger price and set the delay time (an integer within [0-3600]s). When the trigger price is set higher than the current market price, the grid strategy is triggered to start grid trading when the market price is greater than or equal to the trigger price; When the trigger price is set lower than the current market price, the grid strategy is triggered to start grid trading when the market price is less than or equal to the trigger price.

Trigger condition 3: RSI-14 (to be set manually) After the trigger type is RSI, the system provides preset parameters:

-Spot grid/contract grid-long multi-strategy trigger value: 30 k line period: 3m trigger condition: lower-contract grid-short strategy trigger value: 70 k line period: 3m trigger condition: higher-contract grid-neutral strategy trigger value: 50 k line period: 3m trigger condition: crossing

RSI parameters can also be adjusted according to the actual situation: trigger value: K-line period (integer from 1 to 100) needs to be entered: 3m, 5m, 15m, 30m, 1H, 4H, 1D and 3D trigger conditions can be selected from the drop-down box; the drop-down box can select below, above, through, down through and up through RSI trigger, and the delay time can also be set to control the time interval between the market price hitting the preset price and the start of execution.

4) In the Advanced Settings area, you can also set conditions such as take profit and stop loss, and enrich the strategy model.

5) After all the parameter settings are confirmed, you can create a strategy. After the strategy is created, you can view and manage the grid strategy in Strategy at the bottom of the transaction page. During the operation of the strategy, the benefits generated by grid arbitrage can be extracted at any time, or the grid can be stopped.

Recommend Apps