Citigroup said bitcoin was at the critical point of becoming mainstream, and Goldman Sachs restarted the cryptocurrency trading counter.

Nov 23, 2024

With the rise of US stocks, after Bitcoin closed down for three consecutive days, the Ouyi OKX market showed that Bitcoin closed up on March 1, with a one-day increase of over 13%. Also on the same day, Citibank, an American banking giant, released a report called Bitcoin at the Critical Point.

In this 108-page report, Citigroup pointed out that although the future of Bitcoin is still uncertain, with the popularity of Tesla, PayPal, MasterCard and other companies, and the acceleration of central banks' exploration of their own digital currency, Bitcoin is likely to be at a critical point of large-scale transformation.

"The most significant difference between this bull market and the past is that institutional users are increasingly interested in Bitcoin. More and more institutional investors believe that Bitcoin can hedge inflation, diversify investment portfolios, and act as a safe haven that traditional government bonds cannot provide." Citigroup wrote in the report.

Indeed, according to bitcointreasuries.org data, there are currently 42 companies holding over 1.35 million bitcoins, accounting for 6.43% of the total supply of 21 million bitcoins, with a total value of over 65 billion dollars. The biggest holder is Grayscale, which has 649,100 bitcoins. The table also lists 22 listed companies holding bitcoins, among which MicroStrategy and Tesla rank first and second with 90,800 and 48,000 bitcoins.

Citigroup cited another example to prove the increase of institutional activity in bitcoin. From October 2020 to January 2021, the open position of bitcoin contracts on CME increased by over 250%, and this data has always been regarded as the benchmark of institutional activity in the industry.

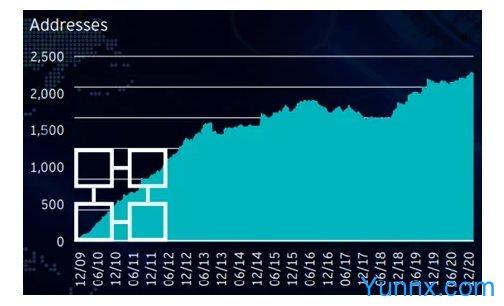

The Coin Metrics chart quoted in Citigroup's report shows that the number of addresses holding more than 1,000 bitcoins continues to increase as the price of bitcoin rises, indicating that more high-net-worth individuals are investing and hoarding bitcoin.

Citigroup's report pointed out that people's awareness of the importance of Bitcoin is constantly evolving, and more and more people think that Bitcoin is becoming the mainstream. The characteristics of Bitcoin, such as decentralization, borderless, rapid transfer of funds, safe payment channels and traceability, coupled with its global influence and neutrality, may make Bitcoin the "preferred currency" for international trade.

However, Citigroup also pointed out the obstacles that Bitcoin still needs to overcome before it becomes a mainstream payment tool, such as capital efficiency, insurance, custody, security and environmental, social and governance (ESG) problems brought about by bitcoin mining ... A little carelessness may lead to "speculative implosion", which is also the origin of the "tipping point".

Although the security problems of cryptocurrency occur from time to time, it performs better than traditional payment. According to the data of Chainalysis and Federal Reserve cited by Citigroup, criminal activities accounted for 0.34% of the total transaction volume of cryptocurrency in 2020, which was lower than 2.1% in 2019. It can be seen that it is an obvious misunderstanding that Bitcoin is considered as the main channel of illegal activities.

Recommend Apps

Preview: