ALGO trading software is a computer program that can automatically execute buying and selling operations based on pre-set rules. This type of software is typically used in financial markets such as stocks, futures, forex, and cryptocurrency markets. By using complex mathematical models and statistical methods, these programs can make decisions in milliseconds, capturing trading opportunities brought by brief price fluctuations.

Functional characteristics

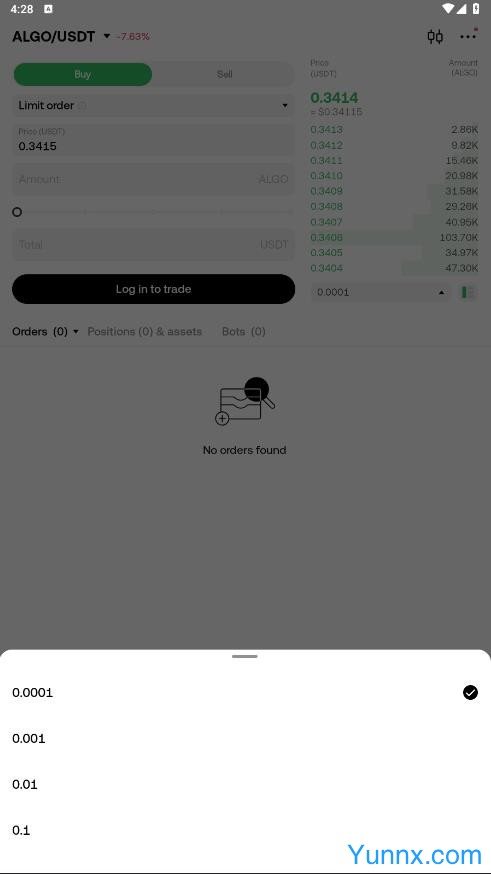

Real time data analysis: An excellent algorithmic trading platform should have strong data processing capabilities and be able to obtain and analyze market data in real-time. This helps traders to quickly respond based on the latest market trends.

Backtesting function: Before actual deployment, users can simulate and test the strategy based on historical data to evaluate its performance. This approach can help eliminate ineffective or loss making strategies while optimizing effective ones.

Multi market support: Platforms like AlgoTrader are not limited to a single market, but can operate between multiple exchanges, covering multiple fields such as forex, options, futures, stocks, and commodities.

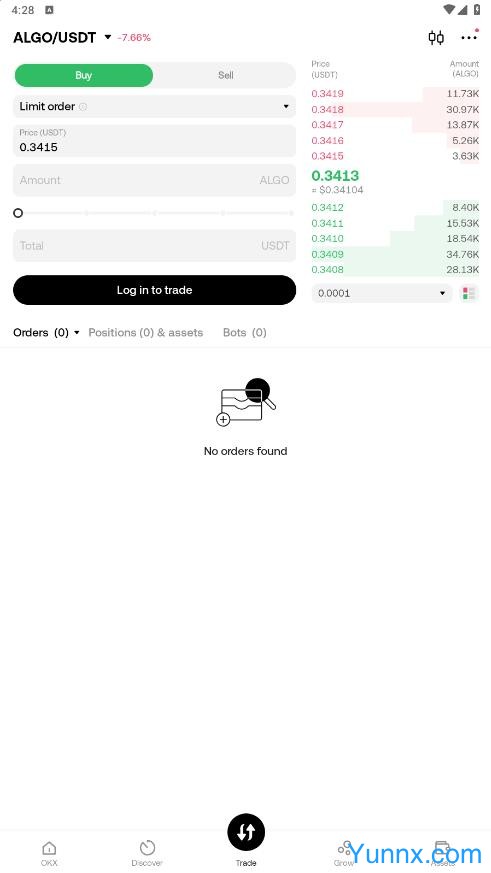

Low latency connection: In order to ensure the speed and accuracy of order execution, many algorithmic trading platforms provide direct access to brokerage systems, reducing market/trading delays.

Risk management tools: A good algorithmic trading system will have various risk control mechanisms built-in, such as stop loss orders, limit orders, etc., to protect investors from the impact of extreme market conditions.

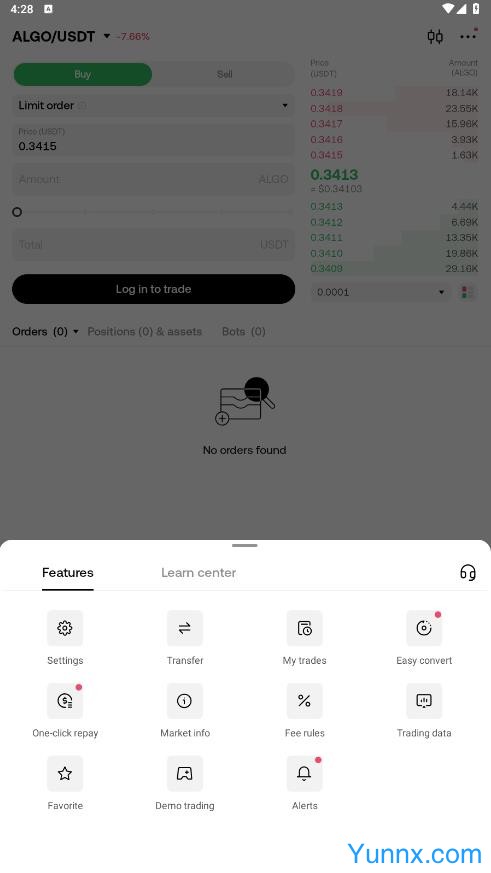

Flexible API interface: Some advanced algorithmic trading platforms also open APIs, allowing developers to create custom policies or integrate with other services.

Continuous optimization: Successful algorithmic traders will constantly adjust and improve their models, seeking new statistical relationships and trading patterns.

Choose the appropriate platform

When considering which algorithm to use for trading software, there are several factors to consider:

Usability: For beginners, a user-friendly and easy to understand operating environment is crucial.

Cost effectiveness: In addition to the initial purchase cost, long-term operating costs such as subscription fees and transaction commissions also need to be considered.

Technical support: A reliable customer support team can provide timely assistance when encountering problems.

Community resources: An active user base means more learning materials and communication opportunities.

Implementation steps

Starting to use algorithmic trading is not an overnight process, it involves a series of detailed planning and preparation:

Determine personal investment goals;

Choose a trading platform that suits oneself;

Learn necessary basic knowledge and technical skills;

Develop and test trading strategies;

Apply appropriate risk management measures;

Regularly review and improve existing strategies.