JST (JUST Token) is the governance token of JUST, a stablecoin project launched by Tron public chain. The project aims to provide a stablecoin USDJ anchored to the US dollar through a decentralized approach, with JST playing a crucial role in participating in project governance and paying transaction fees for borrowing USDJ on the JUST network.

The functions of JST token

Participation in governance: Holders can participate in the decision-making process of the project by voting on governance proposals proposed by the JUST Foundation through JST.

Payment handling fee: When users want to lend or repay USDJ, JST can be used as a transaction fee, which helps reduce user costs and promote the healthy development of the ecosystem.

Incentive mechanism: In order to encourage community members to actively participate in and support the development of the ecosystem, the JUST team may launch a series of reward programs, such as staking mining, to give back to early participants and long-term supporters.

Issuance and Distribution

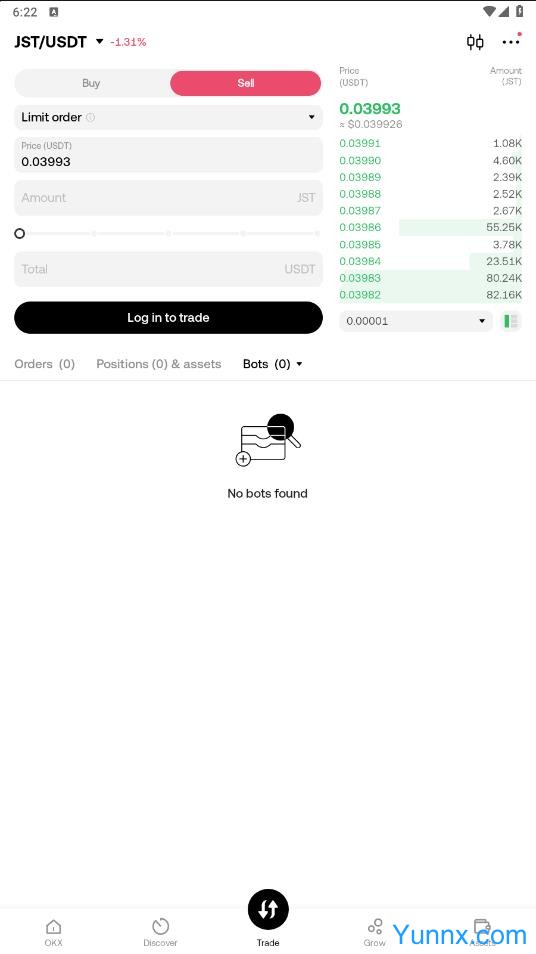

The total issuance of JST is 9.9 billion pieces, and as of the time of report release (August 2020), the circulation is approximately 1.434 billion pieces, with a total of 293927 addresses. According to the latest data from CoinGecko, the price of JST has dropped to approximately $0.04, with a 24-hour trading volume of $5227708511. It is worth noting that changes in market conditions over time can have an impact on the price of tokens, so investors should closely monitor market dynamics.

risk assessment

In the 2020 rating report released by Standard Consensus, JUST was defined as an investment choice with a "higher risk" level, mainly considering the following aspects:

Intense competition: The stablecoin market is highly competitive, with top projects such as USDT accounting for almost 90% of the entire market share, posing a huge challenge for JUST in its early stages.

Insufficient application scenarios: Although USDJ has a certain issuance scale, compared to other mature stablecoins, it still needs to find more large-scale application scenarios, such as payment channels, financial derivatives, and other fields.

Macroeconomic uncertainty: The entire virtual currency market is still in an adaptive period, and factors such as unclear regulatory policies may also have a negative impact on JST's performance.

Technical background

USDJ is issued by decentralized smart contracts in the wavefield network, and users can mint USDJ by pledging TRX. In order to maintain the stability of the exchange rate between USDJ and the US dollar, the system adopts CDP (collateralized debt position) and automated feedback mechanism. In addition, due to the low transfer fees of the Tron network itself, USDJ has an advantage over other stablecoins in certain situations.