Bitcoin, BTC, abbreviated as BTC, is a decentralized cryptocurrency that allows users to conduct peer-to-peer electronic cash transactions without the need for third-party intermediaries. The concept of Bitcoin first appeared on November 1, 2008, in a paper titled "Bitcoin: A Peer to Peer Electronic Cash System" published by a person using the pseudonym Satoshi Nakamoto.

Bitcoin price

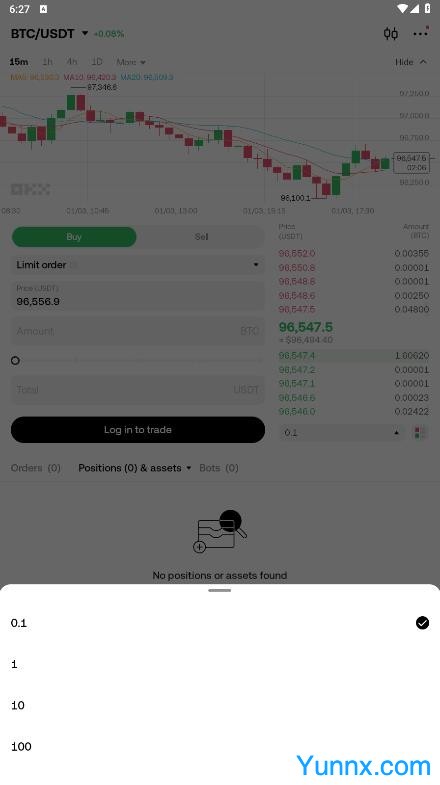

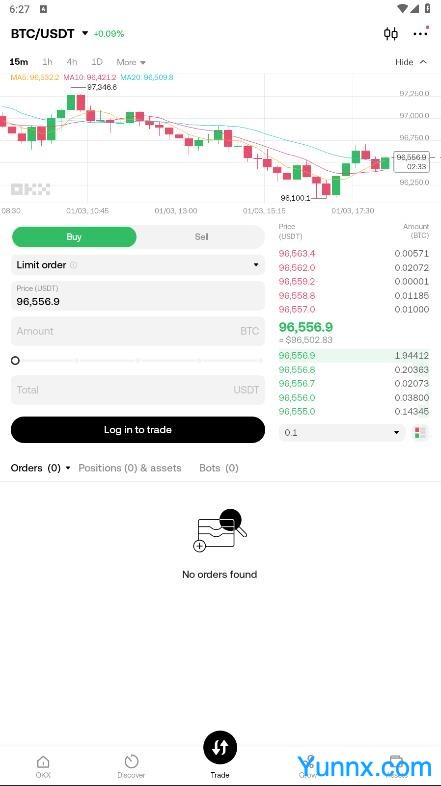

As of the latest data, the price of Bitcoin has shown some volatility. The price of Bitcoin varies depending on different platforms and time points. For example, on the eToro platform, the current price of Bitcoin is $96783.66, with a rate of change of -3.86% over the past 24 hours, and an increase of 2.34% over the past week. Meanwhile, its 24-hour trading volume reached $65.48 billion.

According to data on CoinGecko, the latest price of Bitcoin (BTC) is $96435.30, with a 24-hour trading volume of $62.344 billion. This indicates that the price has decreased by 5.19% in the past 24 hours, but has increased by 2.67% in the past 7 days. In addition, the circulating supply is 19.81 million BTC.

According to information provided by Futu Niuniu, the opening price of Bitcoin was 96954.61 US dollars, with a 24-hour high of 102015.01 US dollars and a low of 96181.81 US dollars. The 24-hour rise and fall was -5.09%, and the transaction volume was 375 million US dollars.

From the perspective of CME Bitcoin futures, in the data on December 27, 2024, the opening price was $96775.00, the highest price reached $97490.00, and the lowest price was $96285.00, with a fluctuation of 1.25%.

It should be noted that the cryptocurrency market is highly volatile and uncertain, so the above prices are for reference only. If you are considering investing in Bitcoin or any other cryptocurrency, please ensure that you fully understand the associated risks and make decisions based on the latest market conditions. In addition, considering that there may be delays or differences in quotes between different platforms, it is recommended that you refer to multiple sources to obtain the most accurate information. For specific financial decisions, professional financial advisors should also be consulted.

The core characteristics of Bitcoin

Decentralization: Bitcoin does not have a centralized issuer or manager, but relies on a globally distributed computer network to maintain and verify transaction records.

Limited supply: The design of Bitcoin is limited to a total limit of 21 million, which means that over time, newly generated Bitcoin will gradually decrease until it eventually stops producing 1.

Openness and Transparency: All Bitcoin transactions are recorded on a public ledger called blockchain, which anyone can view but cannot easily modify the transactions that have occurred.

Privacy: Although all transactions are public, the identities of participants can be kept anonymous through encryption technology. Each participant has a unique address for receiving and sending Bitcoin, which is not directly associated with their real identity.

Security: Bitcoin uses advanced cryptographic principles to ensure its security, including Proof of Work (PoW) mechanism to prevent double spending issues, and ensures the security of users' funds through asymmetric encryption.

The Historical Development of Bitcoin

Since the first block was mined in early 2009, Bitcoin has undergone a rapid development process. In the early years, Bitcoin was mainly used for small-scale transactions and experimental applications within online communities. As more and more people begin to realize its potential, the price of Bitcoin has also experienced drastic fluctuations. For example, at the end of 2017, the price of Bitcoin reached a historical high of approximately $20000; And in the following period, the price experienced multiple fluctuations.

In February 2023, the International Monetary Fund (IMF) formulated a nine point action plan, explicitly stating that it will not grant official or legal tender status to cryptocurrencies such as Bitcoin. In April of the same year, Binance announced the cessation of support for trading and recharging Bitcoin NFTs, marking a shift in the market's attitude towards Bitcoin related assets. In addition, by the end of 2024, the unit price of Bitcoin exceeded $96000 per coin, demonstrating strong growth momentum.