Bitcoin, commonly abbreviated as BTC, is a decentralized cryptocurrency and peer-to-peer electronic cash system. It was proposed by a person or group using the pseudonym Satoshi Nakamoto in 2008 and was officially born on January 3, 2009, by mining the first block - the so-called "genesis block". Bitcoin is designed to provide a way to transfer value directly on the Internet without being controlled by any central authority.

Technical foundation and characteristics

Blockchain technology: The core of Bitcoin is its underlying blockchain technology, which is a distributed ledger technology that allows all participants to jointly maintain a constantly growing list of transaction records without relying on third-party intermediaries. Each new block contains the hash value of the previous block, forming an immutable timeline.

Proof of Work (PoW) consensus algorithm: In order to ensure network security and prevent double payment issues, Bitcoin adopts the Proof of Work mechanism. Miners compete to create new blocks by solving complex mathematical problems, and the successful ones will receive a certain amount of newly issued Bitcoin as a reward. This process not only ensures the security of the system, but also achieves the gradual release of currency.

Limited Total Quantity: Bitcoin is designed to have scarcity, with a permanent limit on the total supply of 21 million coins. This setting imitates the limited nature of natural resources such as precious metals like gold, endowing Bitcoin with certain anti inflation characteristics.

Public transparency but strong anonymity: Although all Bitcoin transactions are publicly recorded on the blockchain, the identity information of participants is not directly exposed. Users can use public key addresses for transactions, which are not directly associated with personal identity, thus ensuring a certain degree of privacy protection.

Market performance and development history

Since its launch, Bitcoin has experienced multiple price fluctuations and technological innovations, gradually growing into one of the most influential cryptocurrencies in the world. Here are several important milestones:

Early Development: On May 22, 2010, a programmer exchanged 10000 bitcoins for two pizzas, which was considered the first time Bitcoin was used for physical commodity trading and was jokingly referred to as "Bitcoin Pizza Day". In July of the same year, the world's largest Bitcoin exchange, Mt The establishment of Gox marks the beginning of Bitcoin's entry into a broader public eye.

Price increase: With more and more people learning about Bitcoin and the blockchain technology behind it, the market's interest in Bitcoin is growing. Especially during the period from late 2017 to early 2018, the price of Bitcoin soared to a historical high of nearly $20000, attracting a large amount of media attention and individual investors flooding into the market.

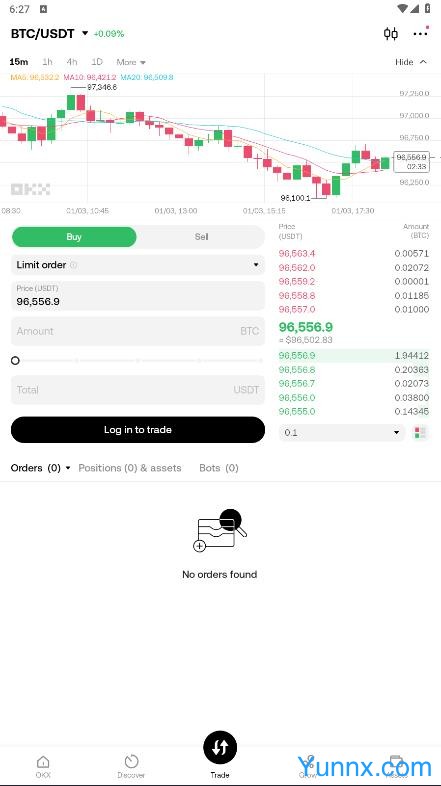

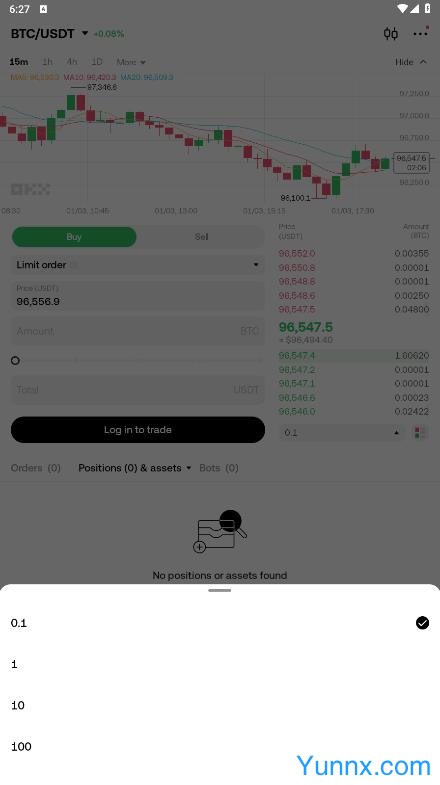

Recent developments: As of December 23, 2024, the price of Bitcoin has surpassed $96000 per coin, demonstrating strong growth momentum. However, it is worth noting that despite the significant increase in the value of Bitcoin in the past few years, it still faces uncertainties from regulatory policies, technological challenges, and market competition.

Social Impact and Future Prospects

Bitcoin is not just a financial tool, it also represents a new economic concept and a force for social change. On the one hand, Bitcoin provides a way to replace the traditional banking system, especially for those living in areas with underdeveloped financial services; On the other hand, it has also sparked in-depth thinking on issues such as the nature of currency, trust building, and power distribution.

Looking ahead, with the continuous development of blockchain technology and the cryptocurrency field, we can foresee that Bitcoin will continue to have a profound impact on a global scale. Meanwhile, in the face of constantly changing market demands and technological advancements, the Bitcoin community is actively exploring how to further optimize the protocol, improve scalability, and enhance user experience. In short, whether as an investment asset or as a means of payment, Bitcoin has become an indispensable part of the modern fintech industry.